Outlook looks troubled for retailers

Mark Whiteley, a credit insurance and surety specialist for Xenia addressed last week’s GIMA conference. He explained how the group helps suppliers protect against the risk of bad debt and advises garden suppliers.

If there is an insolvency it will negotiate on a supplier's behalf as they did with Wilco where many suppliers were caught with outstanding debts.

He warned that it was essential that suppliers have an ‘All monies’ clause in the retention of title terms to prevent liquidators selling off their stock. It reserves title in all goods supplied to the buyer until all outstanding invoices from the seller are settled.

Retail is having a difficult time

Fiona O'Brien of TMHCC is one of the underwriters that is used by Xenia and followed Mark Whiteley to the stage.

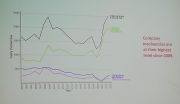

She explained that retail is having a difficult time at the moment because spending is falling and interest rates are rising. In volume terms retail sales fell by 2.8% in 2022 and 2.5% in 2023.

Retailers are protecting cash flow and liquidity and are limiting capital expenditure to maintenance and some warehouse expansion.

Outlook looks troubled

January 2024 sales volumes rose by 4%, but the outlook looks troubled. Consumers are still cautious and many retailers will be faced with refinancing their debt this year and next year at much higher rates.

Corporate failures are the highest since 2009. The number of insolvencies is expected to increase from 25,000 last year to 30,000 this year. The construction sector and retail are the worst affected.

The advice to a supplier is to secure a two or three year contract with a credit insurance underwriter. They keep close contact with retailers, who could be in distress. Suppliers thus have insurance and are better informed about the risks they take when deciding who to extend credit to.

More retailers have negotiated repayment plans with their suppliers to manage their cash flow. The warning signs come when a retailer is not sticking to agreed payment arrangements and when they start paying some suppliers and not others.

The broker indicated that there are two companies within the sector that are currently being talked about. Although confidentiality prevented them from being named. The names under discussion at the coffee break during the GIMA conference were Homebase and Dobbies.

The Times recently revealed that accounts for Homebase (HHGL ltd) show heavy losses and sales down 11% in 2022, a challenging year.